Home

About Projects Publications Contact

Home

About Projects Publications Contact

Markets

Capacity and interruptible load markets

![]()

Wholesale electrical

energy markets were instituted with the deregulation of vertically integrated

utilities in 1978. Electricity generators (fossil fuel plants, nuclear, wind,

solar …) compete with each other to sell electricity to end users and local distribution

utilities. In energy markets, each generator bids a price to sell a certain amount

of electrical energy (kWh, kilowatt-hours) for the following day. These kWh bids

are tabulated according to price, and a price is struck where the energy bid

equaled total energy demand. Generators who bid less than the strike price received

the strike price (market clearing price) for electricity.

Energy

markets are imperfect. By bidding a price for energy (kWh), generators were

bidding their variable cost and there was no incentive to make new capital investments.

Old generators with fully depreciated hardware have a cost advantage over new

generators with mortgages (debt). The result is that systems develop capacity

shortfalls which must be patched with special contracts or with supplementary capacity

markets.

CAPACITY (POWER) MARKETS

All clean

energy generators (hydro, wind, solar, nuclear, geothermal electric) have

little operating cost and substantial capital cost. This means that a fair

market (aligns price with cost) would mainly compete the ability to deliver

power (kW) not energy (kWh) during peak load. As the grid becomes clean, electricity markets

will shift from being energy markets to being capacity markets to deliver

reliable electric power. In a capacity market, generators offer a price for

delivery of a certain amount of power (kW) during peak loads. Wind (negatively

correlated with peak loads) would need to be paired with seasonal storage to reliably

deliver power during peak loads.

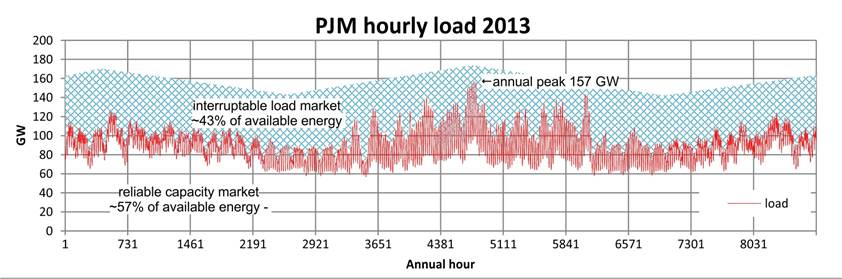

INTERRUPTABLE LOAD MARKETS

Once a clean electric

power system has sufficient capacity to satisfy peak load (for PJM 2013 figure below

annual peak is 157 GW), it costs little more to operate that system full time

at peak capacity. The excess electricity, beyond that required to satisfy

hourly load with high reliability requirements, can be sold cheaply to electricity

applications with low reliability requirements. This is the separate interruptible

load market. Examples of interruptible load applications are buildings that can

switch between natural gas and heat pumps based on lowest market price; also

the electrolytic generation of hydrogen.

The figure below shows that once a clean system is

designed to deliver reliable peak load electricity, the energy available on a

low cost interruptable basis is about 43% of the energy

available from capacity needed to reliably satisify

peak load.

[This figure notionally illustrates 15% reserves, 5% forced outage rate and 20%

seasonal maintenance drawdown.]

Both capacity

markets and interruptible load markets are inevitable. Rhodes proposes a structure for interruptible

load markets. Analysis is needed on the impact of diurnal storage on interruptible

load reliability, a more complete assessment of applications, and a transition

plan.